Posts Tagged ‘financial literacy’

Hello friends and Welcome to Money Monday

Hello friends and Welcome to Money Monday

Remember last month when I told you that hubby couldn’t buy me a gift for my birthday? Well after checking his bank statement a few days earlier, he realized that there had been some fraudulent charges made against his account. Luckily, they weren’t excessive, but after contacting the bank his debit card was immediately suspended, oh by the way, there’s a charge for a replacement, which I think is unfair but that’s another story for another Money Monday.

Anywho, I’m glad that he had finally heeded my warning in making sure to check his statements as well as any credit card or medical bills that were received in the mail. There are so many ways for scammers to get you and it doesn’t just happen during the busy holiday season.

Scammers and fraudsters are ever vigilant, therefore, as wise consumers we must be the same, so here is a list of 12 tips to help you avoid fraud and keep the scammers at bay!

- Install a lockable mailbox to reduce mail theft.

-

Limit the number of credit cards you have.

-

Reconcile your check and credit card statements as soon as possible, and immediately challenge any purchases that you did not make.

-

Scrutinize your utility and subscription bills to make sure the charges are yours.

-

Keep a list of all your credit and bank accounts in a secure place so you can quickly call the issuers to inform them about missing or stolen cards. Or make a copy front and back of your cards with the numbers to customer service and fraud departments.

-

Do not toss pre-approved credit offers in your trash or recycling bin without first tearing them into small pieces or shredding them. Dumpster divers can use these offers to order credit cards in your name and mail them to their address. Always do the same with other sensitive information, such as credit card receipts and phone bills.

-

Avoid credit repair scams. If you are tempted to contact a credit repair company for help, use considerable caution. The FTC and a number of state attorney generals have sued credit repair companies for false promises to remove bad information from credit reports. Only inaccurate information may be removed from your credit report; negative information that is accurate (such as a bankruptcy filing or a defaulted loan) will stay on your credit report as long as governing laws allow.

- Never give any credit card, bank or Social Security information to anyone by telephone unless you can positively verify that the call is legitimate.

- Minimize exposure of your Social Security and credit card numbers. If the numbers are requested for check-cashing purposes, ask if the business has alternative options, such as a check-cashing card.

- Do not have your bank send your new checks to your home address. Tell the bank that you prefer to pick them up.

- Destroy all checks immediately after you close a checking account. Destroy or keep in a secure place any courtesy checks that your bank or credit card company sends to you.

- Do not allow your financial institution to print your Social Security Number on your personal checks. I remember when your social security numbers were not only printed on your checks but also on your driver’s license as well. Times sure have changed!

Have you ever been a victim of a scammer, whether online, via the telephone or mail, if so, then you know how difficult, time consuming and sometime costly it can be to get things back on track.

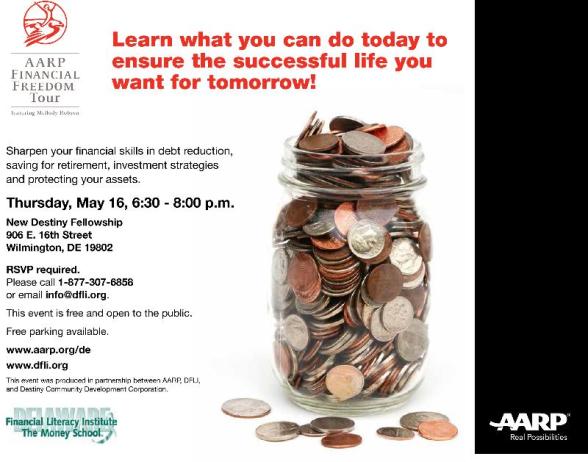

Check www.aarp.org/fraudwatchnetwork if you are concerned about an organization that doesn’t sound legitimate and call 877-908-3360 which is the AARP Foundation Fraud Fighter Center.

Better Safe than Sorry!

Stay Blessed ~ No Stress in 2014!

23 Comments

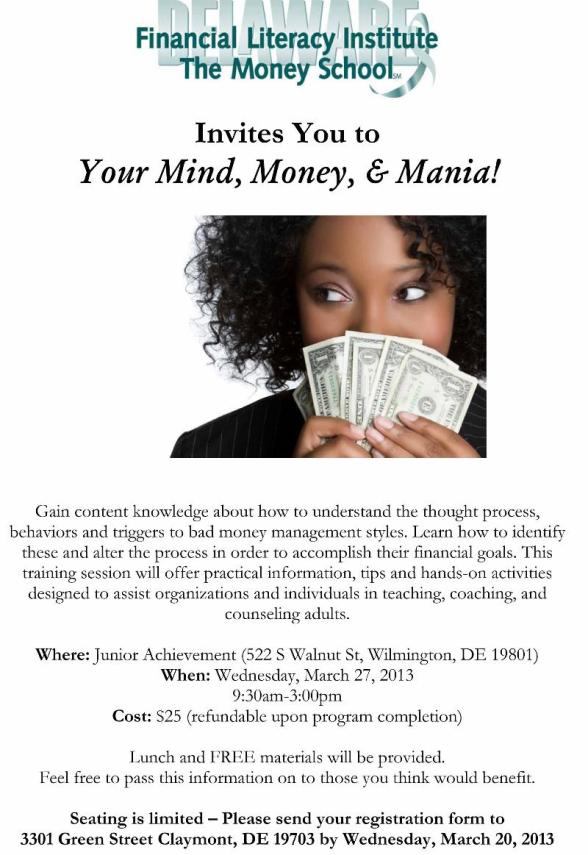

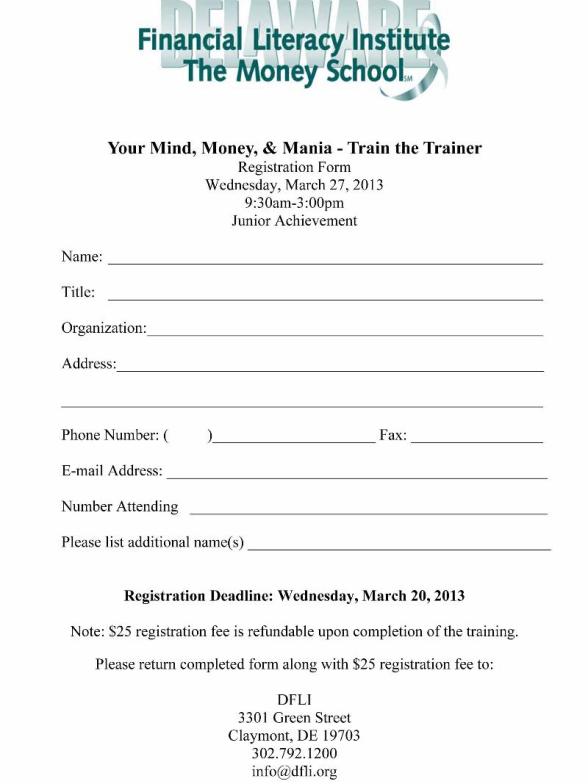

On Saturday, the Delaware Financial Literacy Institute, held it’s annual From Purses to Portfolios Celebration at the Chase Center on the Riverfront.

This event was held to honor the 2013 Award Recipients, those who had achieved various levels (hours) by participating in Money School Classes, Money Clubs, Special Events and Volunteering. Women achieving various levels ranging from 1-15 hours and up to 250 hours were being recognized, the highest achievement being the Ambassador of Financial Education ~ 250 hours.

The recipient of this award was Elizabeth “Penny” Church for her “Penny’s 2 Dollars Money Club” and she also received the Sandra A. Varano Golden Purse Award.

The other categories of recognition were: Money School Advocate Awards; Executive Director’s Awards and Outstanding Volunteer Awards of which I was also a recipient due to the volunteer hours of instruction for the Blogging 101 and Blogging for Your Small Business classes.

The From Purses to Portfolios Celebration was held in a beautifully decorated ballroom, and on each table there was a vibrant Autumn Mum and a small Gift Bag on each seat. Inside the Gift Bags was a pink FAB pen, Note Cards, “friends don’t let friends drown in debt” magnet, a donation envelop, a card advertising “Money Letters” and a retractable measuring tape from Citi, who was the major sponsor.

Chasing the Dream Exhibitors were set up around the ballroom selling products and attendees walked about chatting and networking. In an adjoining room there was a breakfast buffet, warming trays filled with scrambled eggs, bacon, sausage, and fried potatoes. As well as tables of yogurt, pastries, bagels, fruit, coffee, tea and juice.

Ronni Cohen, Executive Director opened the program with a warm welcome and explained the levels of achievement and how they are gained through the Money School of Delaware.

Ronni Cohen, Executive Director opened the program with a warm welcome and explained the levels of achievement and how they are gained through the Money School of Delaware.

Alisha Adams, a Money School instructor gave a beautiful blessing and Quadia Muhmmad, Program Director introduced the Keynote Speaker, Jackie Cummings Koski.

Alisha Adams, a Money School instructor gave a beautiful blessing and Quadia Muhmmad, Program Director introduced the Keynote Speaker, Jackie Cummings Koski.

Jackie Cummings Koski, is the Award Winning Author of Money, Letters 2 My Daughter. As one of 6 children raised by a single dad, where money was always short, finances were taboo to talk about and bad money decisions were made, she knew that she wanted her daughter to make better financial decisions in her life.

She was determined to teach her daughter Amber, financial literacy but in a fun and easy way, one that would appeal to her teenage mind. Jackie began to write letters and those letters turned into a best selling book, one that was sent to and acknowledged by the President and First Lady Obama. Money, Letters 2 My Daughter is available in book stores as well as a downloadable ebook.

Jackie ended her presentation with a Group Activity in which she asked us to answer 1 of 4 questions on a “My Money Letter” form. Those willing to reveal their answer on stage were each given a $2 bill which has been significant in Jackie’s life long savings plan.

Ronni returned to the podium to present the 2013 Awards and Door Prizes which included Gift Cards, a WaWa Gift Basket and Books. One of the winners was a man, but in keeping with the FAB motto of “FOR Women ~ ABOUT Women ~ BY Women AND the men in their lives” is was okay!

A game of “What’s in your Purse” was then hosted by Quadia with the winner of having the most items on her list in their purse receiving the table’s Mum.

The event concluded with a book signing by Jackie and more sales by the Chasing the Dream Exhibitors. It was a great day and another wonderful FREE event sponsored by The Delaware Financial Literacy Institute – The Money School of DE.

The 10th Annual From Purses to Portfolios Event will be held next year on October 25th 2014 – so mark your calendars.

5 Comments

Chasing the Dream Market Day!

Thursday, August 1st

11:00am-1:30pm

Rodney Square in Wilmington

Campers are open for business…come shop over your lunch break!

|

Turn Up The Heat…

August Money School Classes!

Money Smart Series

Wed., July 31, Aug. 7, 14, 21 & 28 Time: 6-8pm

Bear Library

Nicole Henry, Citizens Bank

Participants must attend all sessions to receive certificate.

Lunch and Learn: Social Media and Business

Wed., July 31 Time: 12noon-1:30pm

Claymont Community Center

Stacey Schiller, Stacey Ink

Strategic Ways to Get Out of Debt

Thurs., Aug. 1 Time: 5:30-7:15pm

Dover Library

Rod Hausmann, Primerica

How to Start and Finance Your Small Business Dream

Thurs., Aug. 1 Time: 6-7:30pm

City of Dover Economic Development Office

Tim Reid, SBA

Protecting What’s Important

Tues., Aug 6 Time: 1:00-2:00pm

Kirkwood Hwy Public Library, 6000 Kirkwood Hwy, Wilmington

Steven Lucas, Edward Jones

Lunch and Learn: Award-winning Customer Service

Wed., Aug. 7 Time: 12noon-1:30pm

Claymont Community Center

Dinette Rivera, Rivera Business Development Group

Light lunch provided

Foreclosure Prevention

Mon., Aug. 12 Time: 6:30-8:30pm

Newark Library, 750 Library Ave., Newark

Mary Rammel, CCCS of MD and DE

Foreclosure Prevention

Mon., Aug. 12 Time: 6-7:30pm

Georgetown Library, Job Center

Lisa Spellman, Department of Justice

A Mortgage Acceleration Review

Mon., Aug. 12 Time: 6:30-7:30

Rosehill Commuinty Center

Jenine Mills, AGLA

Share your thoughts

Hello Friends and Happy Hump Day Wednesday.

Today didn’t start out on a high note but it is definitely ending on one. I have been featured in the online publication Pocket Change, check it out on page 19!

Have a fantabulous afternoon – Smooches!

Share your thoughts

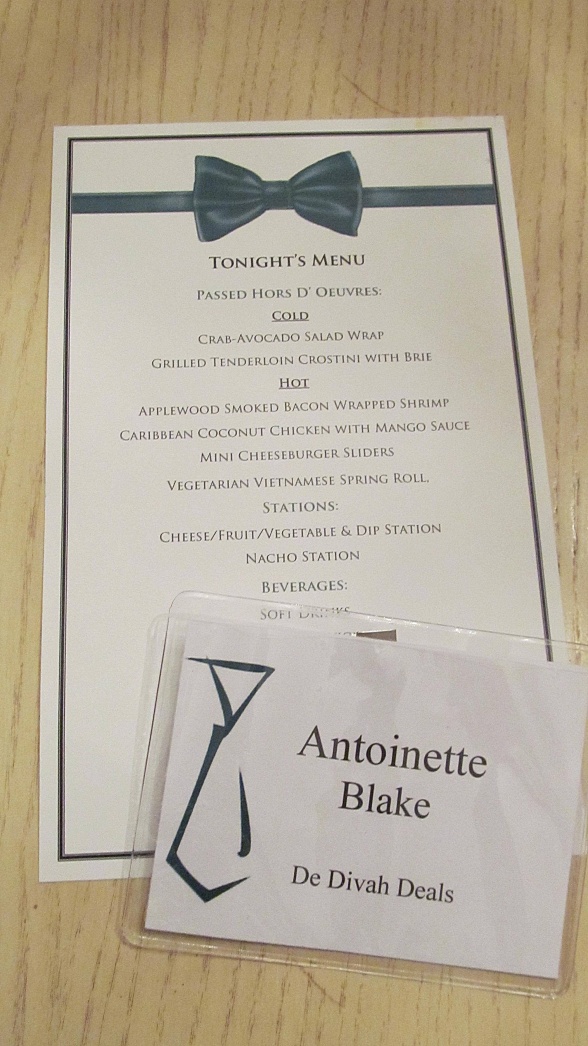

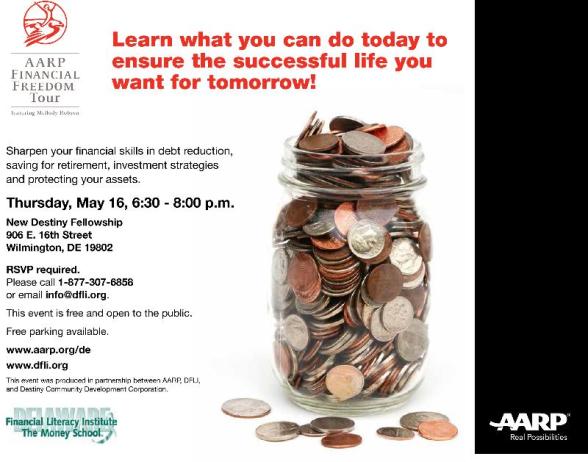

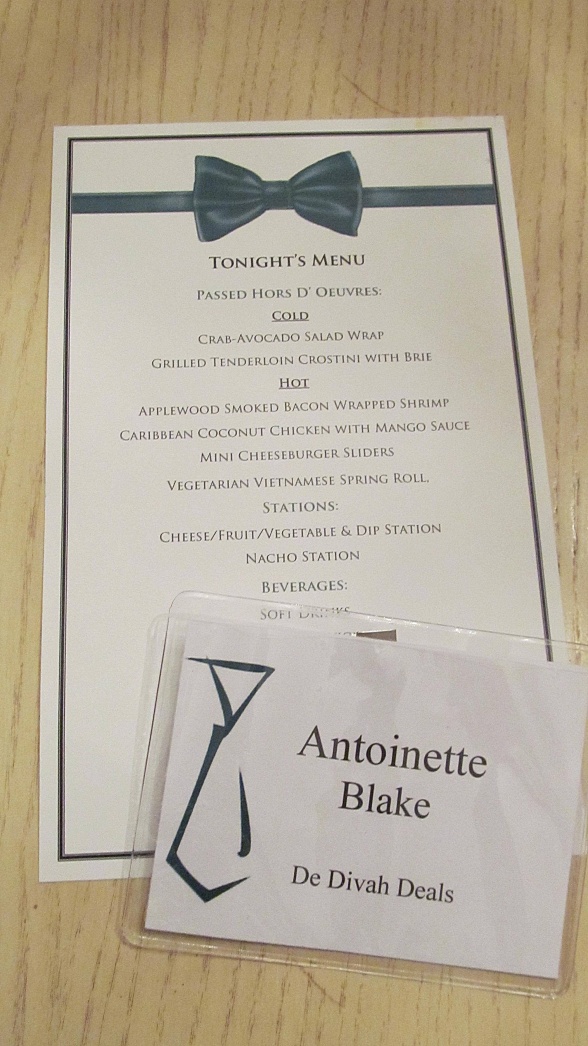

On Thursday night, The Delaware Financial Literacy Institute hosted a “Green Tie Friendraiser” at The Chase Center on The Riverfront. The “green themed” event began at 6:00 p.m. and as guests mixed and mingled waitstaff presented trays of succulent Hors D’Oeuvres which included a Crab-Avocado Salad Wrap; Grilled Tenderloin Crostini with Brie; Applewood Smoke Bacon Wrapped Shrimp; Caribbean Coconut Chicken with Mango Sauce; Mini Cheeseburger Sliders and Vegetarian Vietnamese Spring Rolls.

On each table there was a “What’s Your DFL-IQ” sheet that contained clues about the program, completed forms were then entered into a drawing for a chance to win a Gift Card with Travel Mug or a Basket of Wines. The mellow sounds of A-Z Music was heard as they played smooth Jazz throughout the evening. Mary Caraccioli, The Money Confidant, began the presentation with the history of DFLI, a not-for-profit organization that provides FREE financial literacy programs and the importance of the local business support. Emilio Cooper, Board President and a rep of Citizen’s Bank, a Corporate Sponsor also spoke and announced that DFLI had recently received the 2013 Excellence in Literacy Award – Non Profit. Ronni Cohen, Executive Director also spoke briefly and introduced her small, hardworking staff as well as a video that contained testimonies and accolades from several participants and instructors who were also present at the evening’s event.

The highlight of the evening were the eloquent remarks from Victoria Acosta, she and her sister Samantha are “smallpreneurs” whose family business, Precious Pillows, was started by Jennifer at the tender age of 10. She spoke of how DFLI planted the seed that allowed her to become successful and they have been chosen to represent their company at a Christian Technology Camp this summer. Victoria is an A+ student, involved in sports and church activities and is truly an inspiration to others in and above her age group.

“May your days be filled with success and your nights with Precious Pillows!”

Dinner was buffet style with Nacho stations as well as a Cheese/Fruit/Vegetable and Dip table. An open bar served soft drinks, a variety of wine, Twin Lakes Winterthur Wheat beer and a special Green Tie Cocktail – Rita’s Juicy Pear Water Ice & Vodka, which was also available as non-alcoholic.

As guests departed they were given a green dfli monogrammed coffee mug containing a bookmark and donation form. It was a wonderful evening and I will definitely contact my employer to request a donation be made to this worthy organization.

5 Comments

April Showers Bring Money School Classes!

Take Control! What Everyone Needs to Know About Basic Estate Planning

Wed., April 24, 6:00-8:00pm

Newark Free Library

Guest Instructor – Mary Culley, Morris James LLP

Show Me My Money

Wed., April 24, 7:00-9:00pm

Hockessin Library

Whitney Singer, Clarifi

Money Matters- Budgeting

Wed., April 24, 12noon-1:30pm

Claymont Community Center

Guest Instructor – Nicole Henri, Citizens

Light Lunch Provided!

Foreclosure Prevention

Fri., Apr. 26, 2:00-4:00pm

Elsmere Library

Mary Rammel, CCCS of MD and DE

DSHA Homebuyer Fair

Sat., April 27, 8:30am-4:00pm

Christiana Hilton

Guest Instructor – Delaware State Housing Authority

Business Fashion Savvy on a Shoe String Budget

Sat., Apr. 27, 12:30-3:00pm

Hillcrest Bellefonte Learning Ctr.

Dr. Jay Macklin, Direct Sales & Home Based Business Network

Understanding Your Credit Report

Mon., April 29, 7:00-9:00pm

Hockessin Library

Whitney Singer, Clarifi

Lunch and Learn: Financial Literacy for the Business Owner

Wed., May 1, 12noon-1:30pm

Claymont Community Center

Dinette Rivera, Rivera Business Development Group

Light lunch provided

Do It Yourself Savings

Thurs., May 2, 12noon-1:30pm

Claymont Community Center

Sharon Ann Boland, Citi Community Development

Strategies for Collecting Social Security

Mon., May 6, 6:00-7:00pm

Newark Library

Michael Connor, WSFS Investments

Finding Balance In Your Budget

Mon., May 6, 6:00-7:00pm

Elsmere Library

Steven Lucas, Edward Jones

Business Travel Savings/Tax Tips

Mon., May 6, 6:00-8:00pm

Hillcrest Bellefonte Learning Ctr.

Dr. Jay Macklin, Direct Sales & Home Based Business Network

Show Me My Money

Mon., May 6, 6:00-8:00pm

Kirkwood Library

Whitney Singer, Clarifi

Share your thoughts

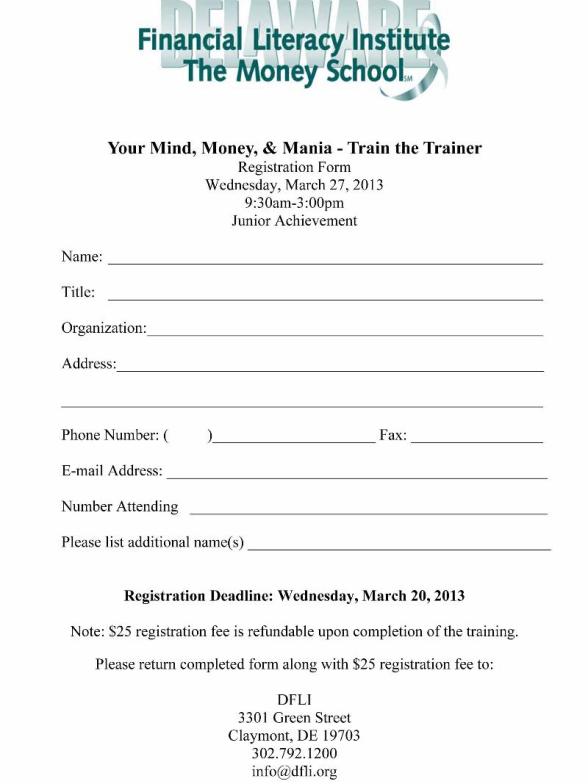

For additional information – DFLI

Share your thoughts

For additional information – DFLI

Share your thoughts

First State Saves Week 2013 as part of the “Got $avings” Program kicks off on Monday, February 25th

“First State Saves Week reminds us to Save Early and Save Often!”

You are invited to attend any of these FREE classes that are intended to help Delawareans build wealth not debt.

19 Ways to Find Money to Invest

Monday, Feb. 25th, 6:30 – 8:30 pm @ Bear Library

* * *

Lighten Up Your Energy Bill

522 S. Walnut Street, Wilmington

Free Parking, Snacks and Door Prizes

* * *

Understanding Standing Loans

Wednesday, Feb. 27th, 12:00 noon – 1:30 pm @ Dover Library

Light Lunch Provided

* * *

Retirement Has Changed, What’s Your Next Move?

* * *

Snowed Under by Clutter

Light Lunch Provided

Classes are Free but registration is required ~ www.dfli.org or 877.307.6858

3 Comments

First State Saves Week 2013 as part of the “Got $avings” Program kicks off on Monday, February 25th

“First State Saves Week reminds us to Save Early and Save Often!”

You are invited to attend any of these FREE classes that are intended to help Delawareans build wealth not debt.

19 Ways to Find Money to Invest

Monday, Feb. 25th, 6:30 – 8:30 pm @ Bear Library

* * *

Lighten Up Your Energy Bill

522 S. Walnut Street, Wilmington

Free Parking, Snacks and Door Prizes

* * *

Understanding Standing Loans

Wednesday, Feb. 27th, 12:00 noon – 1:30 pm @ Dover Library

Light Lunch Provided

* * *

Retirement Has Changed, What’s Your Next Move?

* * *

Snowed Under by Clutter

Light Lunch Provided

Classes are Free but registration is required ~ www.dfli.org or 877.307.6858

Share your thoughts

Hello friends and Welcome to Money Monday

Hello friends and Welcome to Money Monday